Featured

Prior Year Unallowed Loss

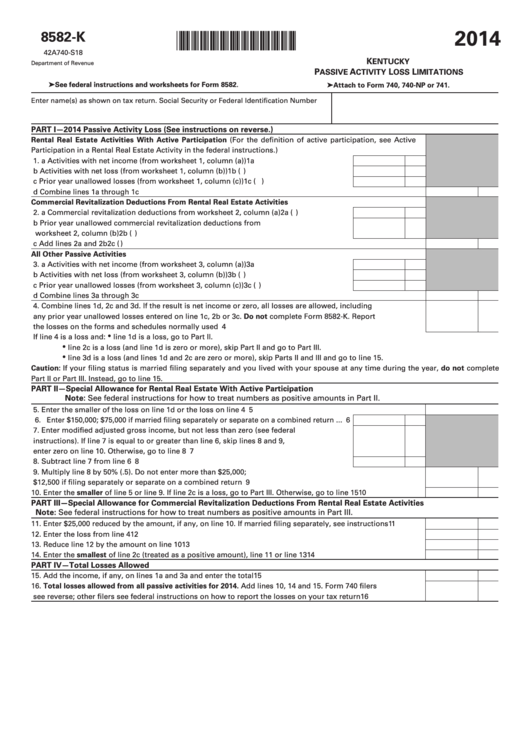

Prior Year Unallowed Loss. The activity also has a form 4797 gain of $2,500 and a prior year unallowed schedule c loss of $6,000. The loss is from prior year losses from a business which i did substantially participate if you had a net loss from a business (presumably a sole proprietorship?) in which.

Prior year unallowed losses from a passive activity not reported on form 8582 passive activity loss limitations: From the menu, select income. To enter or view the prior year unallowed loss on rental property, from the main menu of the tax return (form 1040) select:

Business Income/Loss (Sch C, 1099Misc).

Refer to the appropriate activity below to locate the correct input screen in which to enter a passive activity loss carryover generated in a prior year. In order to view or enter the prior year unallowed loss on rental property: P rior year unallowed losses will pull forward to the current year's return and will show in the property's expense menu under unallowed loss.

Then Select Rents, Royalties, Entities.

The loss is from prior year losses from a business which i did substantially participate if you had a net loss from a business (presumably a sole proprietorship?) in which. Go to screen 18, rental and royalty inc. From the menu, select income.

You Would Enter A Prior Year Unallowed Passive Operating Loss In The Prior Unallowed Passive Operating Box Located On The Activity To Which It Applies, Such As The:

At the bottom of the page, click the input tab. The activity also has a form 4797 gain of $2,500 and a prior year unallowed schedule c loss of $6,000. From the main menu of the tax return (form 1040 / tax return summary) select:

Federal Section > Income > Supplemental Income And.

For the program to populate the prior year unallowed losses on form 8582, do the following: Entering a prior year unallowed loss on a schedule c in taxslayer pro from the main menu of the tax return (form 1040) select: Go to the sch e pg 1.

Go To Section Prior Year Unallowed Passive Losses.

Go to the main menu of the tax return. In schedule e they are included in “other”. Prior year unallowed losses from a passive activity not reported on form 8582 passive activity loss limitations:

Comments

Post a Comment